If you are involved in the process of buying wood pallets for your organization, you may have come across either pallet inventory challenges or pallet price fluctuations in the past 6 months or so.

In this article, we outline the potential causes for both inventory challenges and pricing fluctuations in the pallet market. We will also pinpoint which of these causes are affecting the market currently. By better understanding the challenges pallet companies are facing we can better understand why having a strong pallet supplier focused on customer service is important to the continued success of your pallet program.

What Causes Low Inventory In The Pallet Market?

Low pallet inventory is caused by one or more of the following:

- Changing circumstances within the pallet industry

- Changing circumstances within the industries purchasing pallets

- Changing environmental circumstances

Changing Circumstance Within The Pallet Industry

Changing circumstances within the pallet industry is one of the most common occurrences that can cause low pallet inventory industry-wide.

One example of this is a sudden increase in the price of one specific style or type of pallet affecting the demand of a substitute style or type.

For a more specific example, we can take a look at the current market. Currently, most new pallets are experiencing all-time high prices. This is making some organizations look at more affordable options, such as recycled pallets. If prolonged, this sudden and continuous increase in recycled pallet demand can slowly dry up the inventory of recycled pallets. If prolonged even further, this can lead to even more adverse effects as it is impossible to build a “recycled pallet” out of thin air. In order to have a recycled pallet, whether that is reconditioned or remanufactured, you must start with a new pallet.

Another example can be the pooling / rental sector of the pallet industry running behind on order replenishments. Most organizations participating in a pallet pooling or rental program will have “whitewood” backups to support shipments in case of shortages on the pooling side. If there is a large enough shortage of pooled pallets, the sudden increase in demand of the “whitewood” backups may also lead to low pallet inventory industry-wide for certain sizes, styles, or types.

Changing Circumstance Within Industries Purchasing Pallets

Sudden adjustments to the flow of pallets within an industry, or a large single organization, can also lead to low pallet inventory (regionally or nationally).

For example, let’s say that a certain customer was using an outside vendor to manufacture their final product. The components for the product being shipped to the vendor and the final product being shipped to the customer used the same pallet. However, recently, industry standards changed to require the vendor to receive components on one pallet and ship the final product out on a completely different pallet. This situation would lead to these vendors having to purchase new pallets to ship the final products on. This sudden increase in demand from vendors for the new pallet to meet the updated requirements may put a temporary strain on pallet supply and lead to low inventories.

Changing Environmental Circumstances Can Also Affect The Pallet Market

Natural disasters, such as forest fires, and inclement weather can also affect pallet supply and lead to low inventory. In order for new pallets to be manufactured, sawmills must have the lumber and be operational to produce the wood needed to build the pallets. If a forest fire wipes out the lumber source, or inclement weather prevents operations from running at full capacity, certain regions and industries may face low inventory for a period of time.

The same can be said for pandemics, such as COVID-19, impacting output capacity and flow of lumber.

Current Inventory Situation of The Pallet Market

Currently, most regions in the United States are experiencing low inventories of recycled A and B grade 48×40 GMA pallets – commonly referred to as “cores”.

While we believe there are no reasons to sound any alarms and label the current situation as a “dire shortage”, we are seeing lower volumes than usual of these specific pallets in the market.

The reason for the current market situation is the higher prices the market is currently experiencing for new pallets. This higher price, of course, is being driven by the overall increase it costs to manufacture a pallet due to lumber, nail, and other cost increases. This increase in price for new pallets is leading to a large demand for recycled pallets and, naturally, lowering the supply.

It is important to mention that while most regions in the United States are experiencing lower supply of cores, certain pockets of the country are experiencing no symptoms. This perfectly illustrates how location in the pallet industry can play a large role.

What Causes Pallet Price Adjustments?

Price Adjustments, both increases and decreases, are usually caused by one or more of the following:

- Changing circumstances in the lumber market

- Changing circumstances in supporting markets

Changing circumstances in the lumber markets

The main component that goes into the making of a pallet is wood. This is why the lumber market, and all other markets utilizing lumber, play such an integral role in the price of pallets.

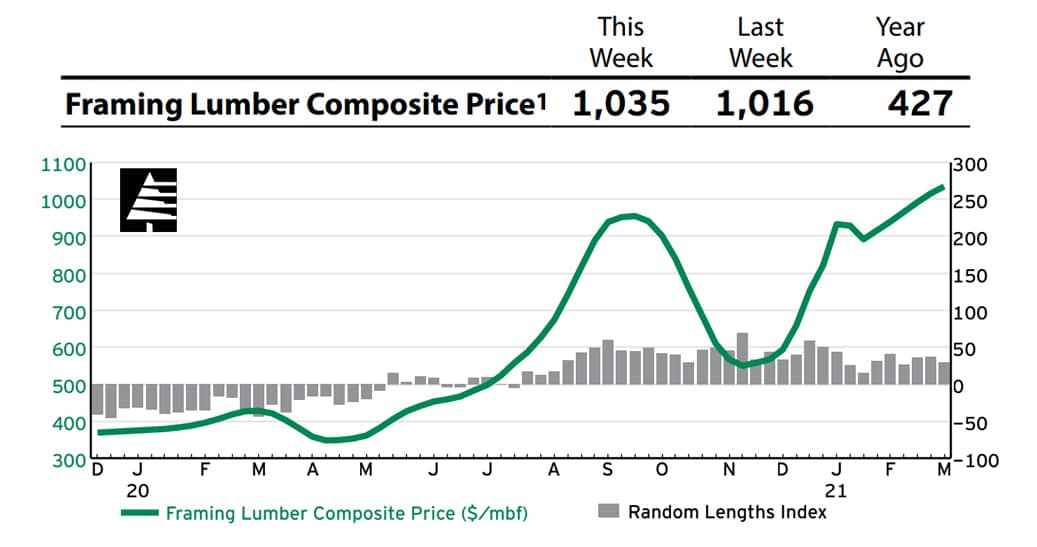

This chart, courtesy of Random Lengths Weekly Report, perfectly illustrates the recent lumber price increases – with the framing lumber composite price increasing by 142% year over year.

Changing circumstances in supporting markets

Most individuals will look at a pallet and only see wooden boards. However, a pallet expert will take a look at that same pallet and see all the other aspects that go into the manufacturing of that product. Aspects such as the nails, nail-guns, machines used, labor, transportation, etc. These factors not only play a large role into making the pallet what it is, but they also affect the price of a pallet. As soon as the cost of any one of these variables rises, so too will the price of that pallet. The same is true in reverse.

Our Pallet Market Analysis

Currently, the increase in pricing being passed through by the lumber market and supporting markets is leading to a direct impact on certain pallet products.

Lumber is currently at an all-time high and is experiencing a 140%-170% increase in price (depending on location and category of lumber). This increase in lumber cost is primarily driven by lower mill production capacity as a result of COVID-19 related impact / health precautions and tariffs placed on Canadian lumber imports. The lumber cost increase is also causing certain higher-end industries that usually do not purchase the same type of lumber used for pallets to do so – thus further decreasing the supply.

The rising cost of nails is also playing a large role in the overall cost of manufacturing a finished product pallet suppliers are experiencing. In a statement to pallet profile, a national sales manager of industrial fasteners for Mid-Continent Steel & Wire had the following to say regarding nail prices

“Everything that goes into making a finished nail, everything has gone up”

This article titled “Rising Steel Prices: A Look At The Economic Factors” does a great job at explaining the reasons behind the increased steel prices.

Takeaway

It is important to remember that the wooden pallet industry, just like any other industry, can and will be affected by outside factors. Whether that is economic, industry supply and demand, or due to a global pandemic. However, these conditions are not permanent. We are confident that conditions will ease up over the next couple of months and into Q3. Sawmills are slowly raising capacity which will ease the demand on recycled pallets and overall stabilize pricing.

It is also important to remember that while these specific conditions are not permanent, it does not mean that the industry will not be facing new challenges in Q4 of 2021, 2022, and so on. With that in mind, you can see why it is imperative that your business has a strong pallet supplier that can adapt to changing market conditions to continue supporting your operations.

Contact Kamps today and see how we put the success of our customers first, even during the current market conditions.